Why OT Demands a New Approach to Asset Inventory

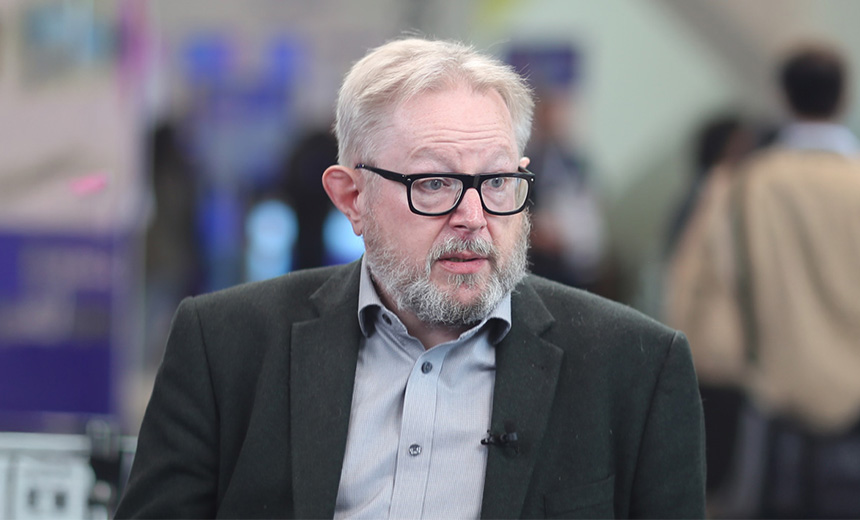

Traditional asset inventory approaches fall short in OT environments where programmable logic controllers and legacy systems create unknown risks, says Grant Geyer, chief strategy officer at Claroty. Accurate asset inventory requires querying these systems in their native protocols to assess risk.